direct tax in malaysia

We dont use your email calendar or other personal content to target ads to you. Income from direct use letting or use in any other form of immovable property shall be covered by the agreement.

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Income up to INR 25 lakhs No Tax.

. Digital newsstand featuring 7000 of the worlds most popular newspapers magazines. 15 of the income tax where the aggregate income is. Tax refund time frames will vary.

Google has many special features to help you find exactly what youre looking for. Malaysias foreign direct investment dropped to MYR 173 billion in Q2 of 2022 from MYR 244 billion in Q1 amid the impact of both COVID-19 disruptions and the war in Ukraine while still marking the seventh straight quarter of net inflow. The recipient ie who pays reverse tax can avail it as ITC.

India has abolished multiple taxes with passage of time and imposed new ones. 2 days agoThe Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards. 25 May 2005 except for the amended provisions under Items 11 and 12 of Part VII Fees and Charges which will take effect at a later date to be notified by Bursa Malaysia Depository Sdn.

110 of 2010 Direct Taxes Code 2013. Cash savings being eaten alive by record-high inflation. Public protests civil violence and food price indices 2012 Figure 52.

Enjoy unlimited reading on up to 5 devices with 7-day free trial. Wealth Tax Act 1957 was repealed in the. Income between INR 25 lakhs-INR 5 lakhs.

10 of the income tax where the aggregate income is between Rs. Foreign Direct Investment in Malaysia averaged 806143 MYR Million from 2005 until 2022 reaching an all time high of 2469041 MYR Million. A TV licence is therefore effectively a.

2421 Extension 4 Jerusalem Post or 03-7619056 Fax. 2009-6-26INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002. The empty string is the special case where the sequence has length zero so there are no symbols in the string.

50 lakhs and Rs. Resident status and income tax in Malaysia. 2022-10-6Outlook puts you in control of your privacy.

2022-3-8The Jerusalem Post Customer Service Center can be contacted with any questions or requests. Both resident and non-resident taxpayers are taxed only on income accrued in or derived from within Malaysia. Political Hardening Index 1996-2011 base year 1996 100.

Were transparent about data collection and use so you can make informed decisions. 2 days agoGiven below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

What if an Input Service Distributor ISD receives supplies liable to reverse charge. Budget and Bills Finance Acts. If tax is due uncommon the penalty is the amount stated above plus 5 of the unpaid tax for each month or part of a month that the return is late up to a maximum of 25 of the unpaid tax.

The term immovable property shall comprise. Taxpayers or by foreign entities in which US. 2022-9-14Is Input Tax Credit ITC allowed under reverse charge.

The fee is sometimes also required to own a radio or receive radio broadcasts. Other Direct Tax Rules. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up.

2022-10-18In 201920 the Direct tax collections reported by CBDT were approximately INR 1233 trillion. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Get your tax refund up to 5 days early.

Leaving Malaysia without payment of tax. Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens. Direct Taxes Code 2010 Bill No.

The penalty for filing late is 5 of the taxes you owe per month for the first five months up to 25 of your tax bill. In Relation to eRAPID Effective. Tax paid on a reverse charge basis will be available for ITC if such goods or services are used or will be used for business.

Best Isa bonds savings and current account rates for 2022. When we collect. Income higher than INR 10 lakhs.

Income between INR 5 lakhs-10 lakhs. Normal Withholding Tax Singapore. We help you take charge with easy-to-use tools and clear choices.

Tax revenues in Africa represent an increasing share of GDP during the last decade 2012 Figure 51. 2 days agoNormal Withholding Tax Malaysia. 2022-10-20A television licence or broadcast receiving licence is a payment required in many countries for the reception of television broadcasts or the possession of a television set where some broadcasts are funded in full or in part by the licence fee paid.

A few of these taxes include inheritance tax interest tax gift tax wealth tax etc. 2022-10-19Get the latest international news and world events from Asia Europe the Middle East and more. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations and FFI agreement if applicable or comply with the.

Search the worlds information including webpages images videos and more. 2015-8-18FATCA requires foreign financial institutions FFIs to report to the IRS information about financial accounts held by US. The IRS issues more than 9 out of 10 refunds in less than 21 days.

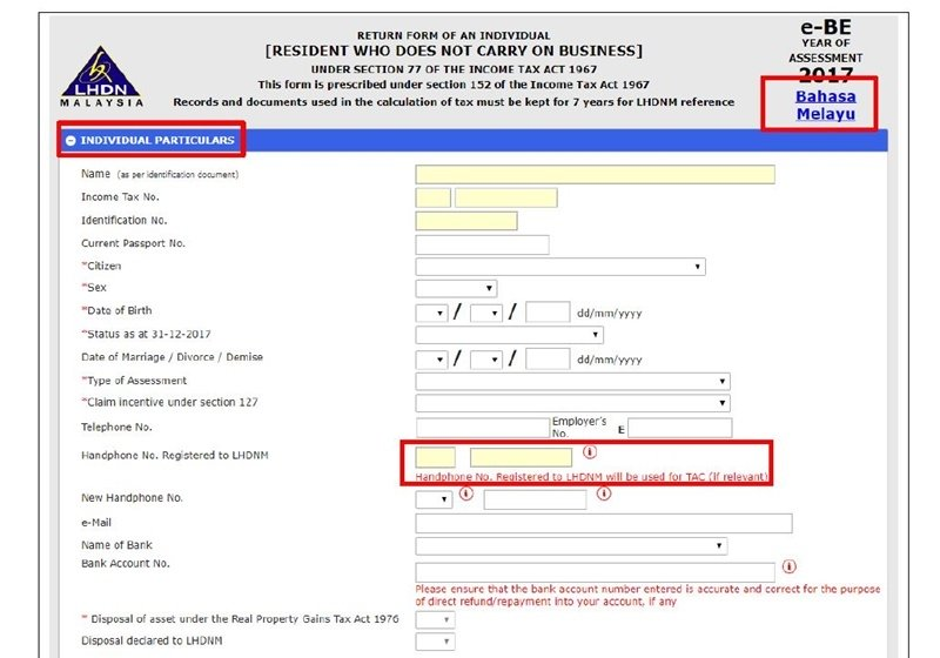

For the most part individuals who stay in Malaysia for at least 182 days or more in a calendar year are. 2022-3-7Amendments to the Rules of Bursa Malaysia Depository Sdn. An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year.

Taxpayers hold a substantial ownership interest. 2022-10-19The outdated inheritance tax rules costing families 137330. Power to direct where returns etc are to be sent.

Fastest tax refund with e-file and direct deposit.

Malaysia Personal Income Tax Guide 2020 Ya 2019

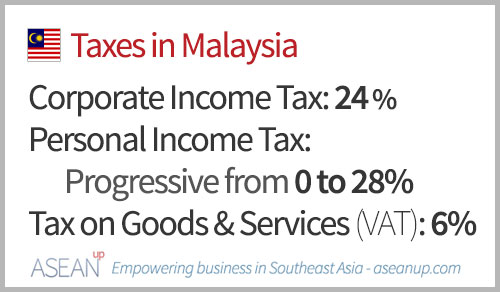

Guide To Taxes In Malaysia Brackets Incentives Asean Up

Malaysia Personal Income Tax Guide 2020 Ya 2019

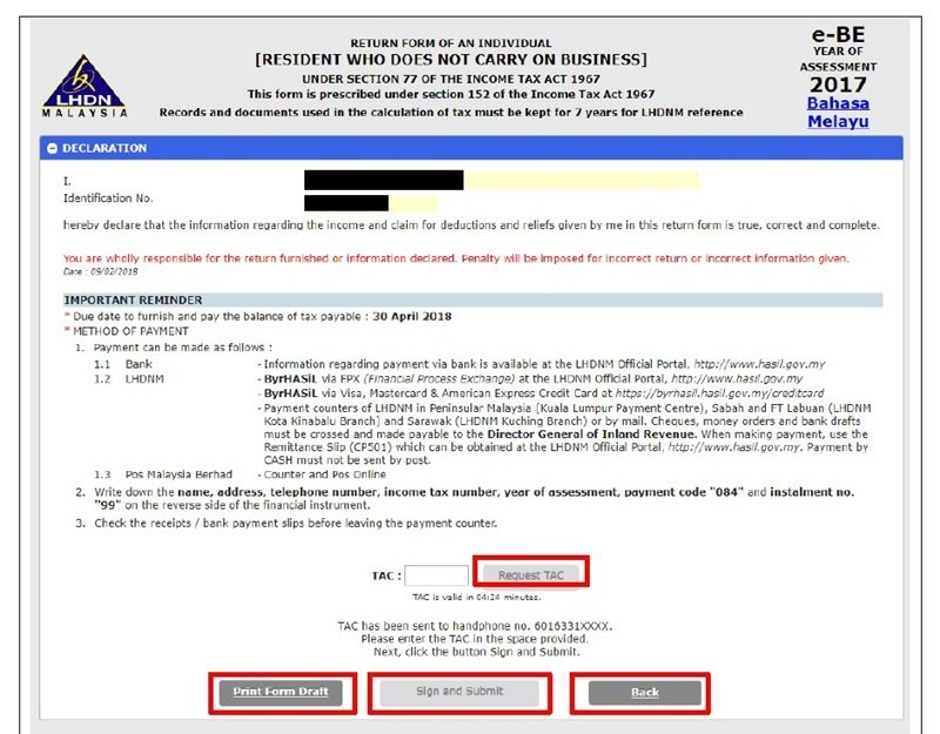

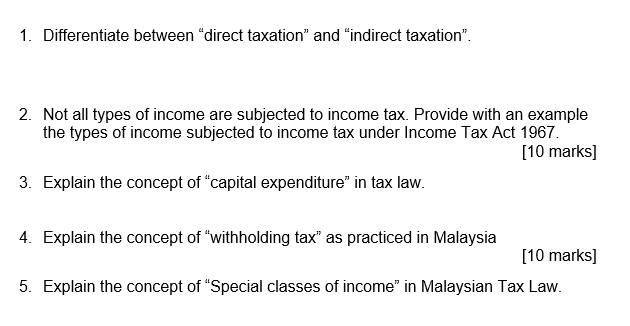

Solved 1 Differentiate Between Direct Taxation And Chegg Com

Estimating The Underground Economy From The Tax Gap The Case Of Malaysia Semantic Scholar

Overly Aggressive Tax Collection A Dampener The Edge Markets

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Figure Direct Income Tax As Percentage Of Gdp For Selected Countries Download Scientific Diagram

Another Brick In The Wall As Though They Are A Major Tax Contributor Up Dated

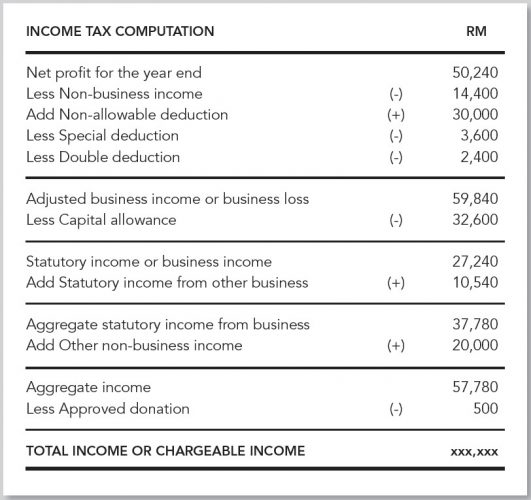

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Personal Income Tax Guide For Expatriates Working In Malaysia 2022

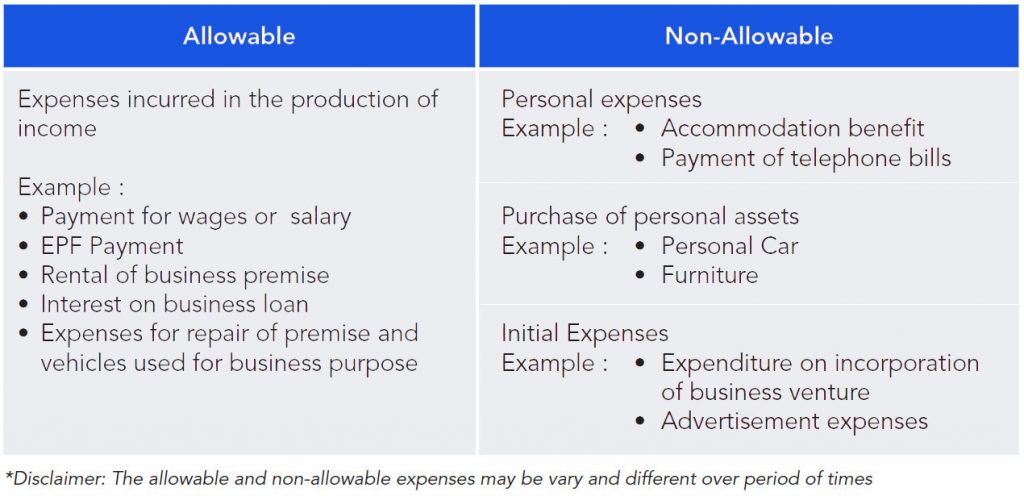

Understanding Tax Smeinfo Portal

Income Tax Malaysia 2018 Mypf My

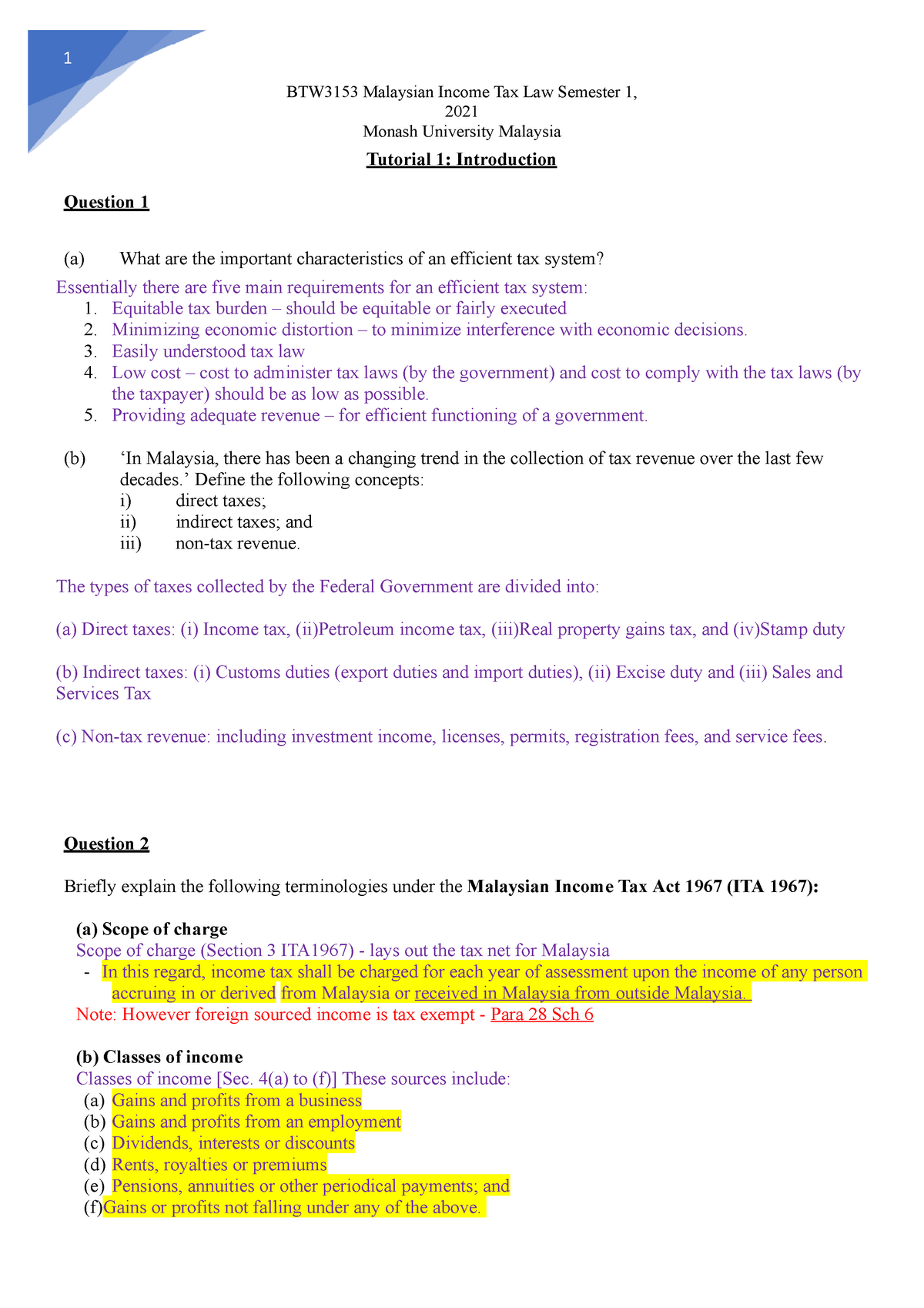

Tutorial 1 Btw3153 Week 1 1 Btw3153 Malaysian Income Tax Law Semester 1 2021 Monash University Studocu

Understanding Tax Smeinfo Portal

Malaysia Personal Income Tax Guide 2021 Ya 2020

0 Response to "direct tax in malaysia"

Post a Comment